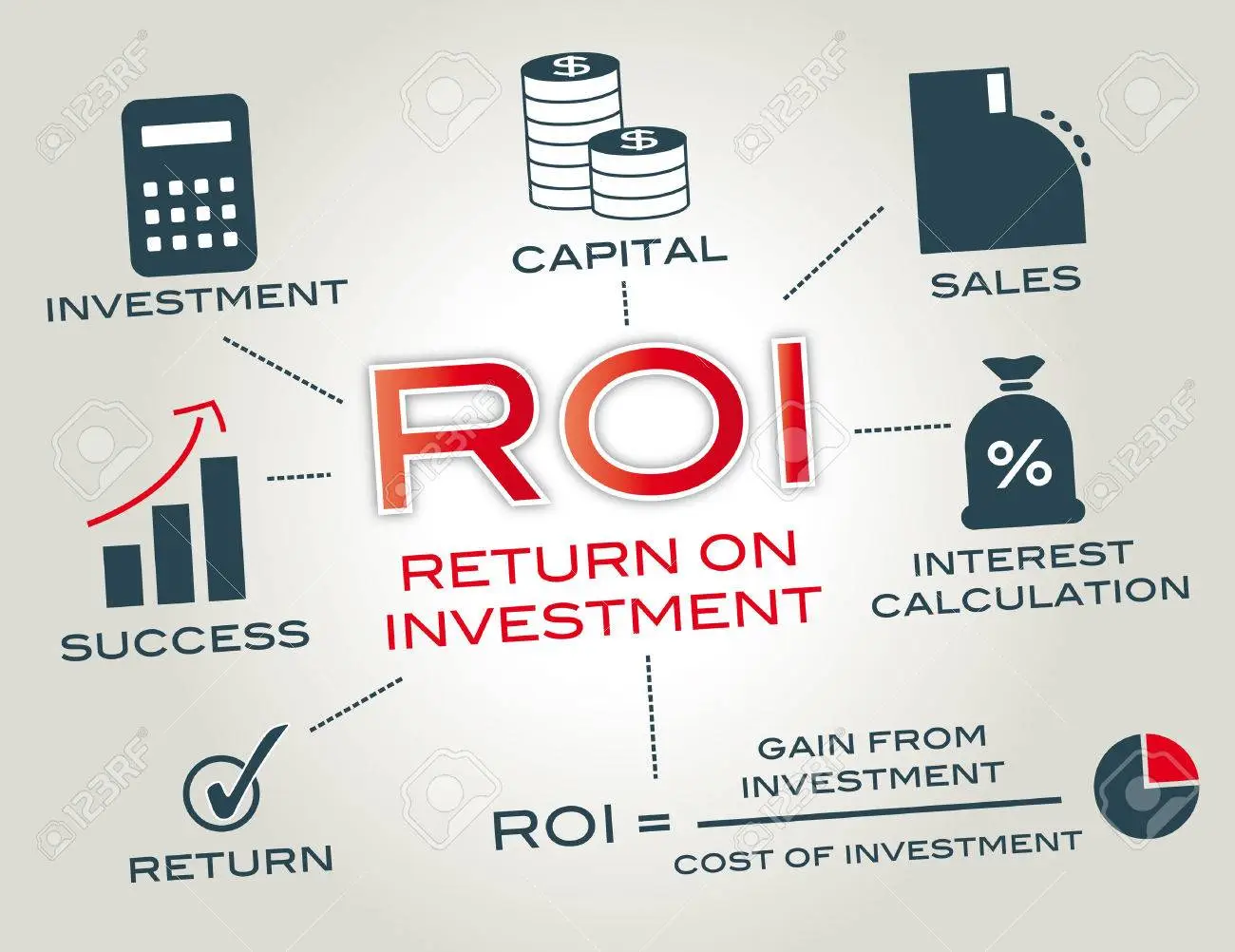

Return on investment (ROI) is a financial metric that measures the benefit (or loss) generated from an investment relative to the cost of the investment. ROI is calculated by dividing the net profit (or loss) from an investment by the cost of the investment. The result is expressed as a percentage.

For example, if an investment costs $100 and generates a net profit of $20, the ROI would be 20%.

ROI is a valuable tool for businesses and investors to measure the effectiveness of their investments. By calculating ROI, businesses can determine which investments are generating the most profit and which investments are not performing as well. This information can be used to make better investment decisions in the future.

There are a number of different ways to calculate ROI. The most common method is to use the following formula:

Code snippet

ROI = (Net Profit / Cost of Investment) * 100%

Use code with caution. Learn morecontent_copy

Net profit is the difference between the revenue generated from an investment and the expenses incurred. Cost of investment is the total amount of money that is invested, including the initial investment and any additional costs that are incurred.

ROI can also be calculated using the following formula:

Code snippet

ROI = (Total Revenue - Total Costs) / Total Costs

Use code with caution. Learn morecontent_copy

Total revenue is the total amount of money that is generated from an investment. Total costs are the total amount of money that is spent on an investment, including the initial investment and any additional costs that are incurred.

ROI can be used to measure the effectiveness of a wide variety of investments, including:

- Marketing campaigns

- Product development

- Sales initiatives

- New business ventures

- Financial investments

ROI can also be used to compare the effectiveness of different investments. For example, a business might compare the ROI of different marketing campaigns to determine which campaign is generating the most profit.

ROI is a valuable tool for businesses and investors to measure the effectiveness of their investments. By calculating ROI, businesses can determine which investments are generating the most profit and which investments are not performing as well. This information can be used to make better investment decisions in the future.

Here are some of the benefits of using ROI:

- ROI can help you to make better investment decisions. By understanding which investments are generating the most profit, you can focus your resources on those investments.

- ROI can help you to improve your business performance. By identifying areas where you are not generating as much profit as you could, you can make changes to improve your performance.

- ROI can help you to attract investors. Investors are more likely to invest in businesses that have a proven track record of generating profits.

Here are some of the challenges of using ROI:

- ROI can be difficult to calculate. There are a number of factors that can affect ROI, and it can be difficult to track all of these factors.

- ROI can be misleading. ROI can be affected by a number of factors that are outside of your control, such as changes in the economy or the market.

- ROI can be short-sighted. ROI only measures the short-term profitability of an investment. It does not take into account the long-term benefits of an investment, such as increased brand awareness or customer loyalty.

Despite the challenges, ROI is a valuable tool for businesses and investors. By understanding the benefits and challenges of ROI, you can use it to make better investment decisions and improve your business performance.

Here are some tips for using ROI:

- Set realistic goals. When setting goals for ROI, it is important to be realistic. If you set your goals too high, you may be disappointed.

- Track your progress. It is important to track your progress towards your ROI goals. This will help you to identify areas where you need to make changes.

- Be flexible. The market and the economy are constantly changing, so it is important to be flexible with your ROI goals.

- Use ROI to improve your business. ROI can be used to identify areas where you can improve your business performance. By making changes to these areas, you can increase your ROI.